This is a good tariff update from our friends at Armada Corporate Intelligence

Negotiated deal announcements like the reported Japan and Indonesia agreements could start coming much faster. Some are firm, some are handshakes, and there is a lot of confusion. But there are a couple of sources out there that are keeping a good tab on the tariffs themselves.

Negotiated deal announcements like the reported Japan and Indonesia agreements could start coming much faster. Some are firm, some are handshakes, and there is a lot of confusion. But there are a couple of sources out there that are keeping a good tab on the tariffs themselves.

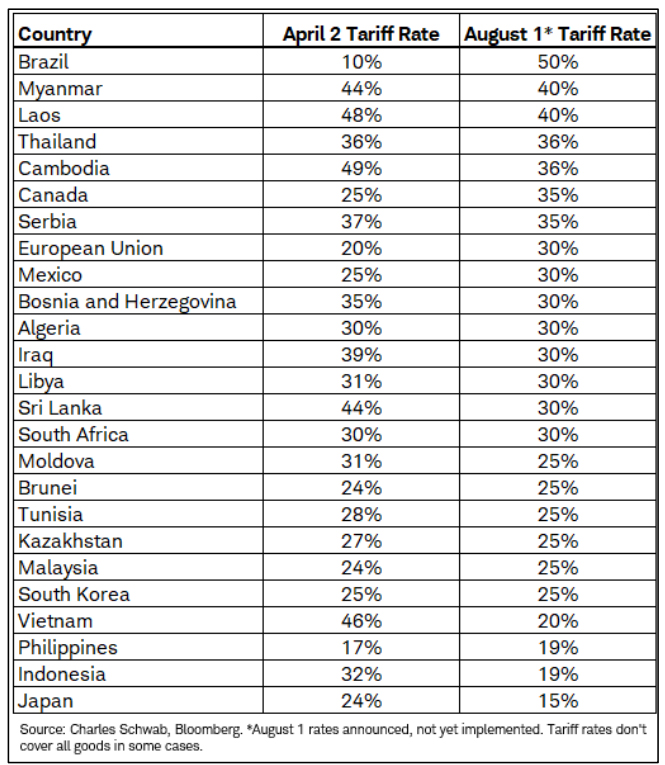

The broader country-based tariff list at right shows the current tariff (if a deal is in place) and the threat for August 1st if a deal is not in place.

I won’t speculate any longer on which deals are close, and which aren’t. In this case, you can’t predict the unpredictable.

Versus the pre-Trump period, here are the transitions coming out of the current trade deals.

Japan: 2% to 15%

Indonesia: 3% to 19%

Philippines: 3% to 19%

Vietnam: 3% to 20%

If all of these tariffs stick, and there is no diversion of trade because of the tariff rate (some of these trading partners may see a shifting of sourcing from China to one of these alternative markets if the final tariff rate for China comes in higher than expected), it is expected to generate a net income difference of ~$49.4 billion annually over prior rates.

As other deals are struck, our eyes will be primarily on the larger markets like China, the EU, Canada, Mexico, Brazil, South Korea, and perhaps Thailand, Malaysia and a few others.

Again, we know historically that higher tariffs can lead to some sourcing shifts – and some of the industrial capacity buildout in the US will eat some of this market share. – KP