by Scott Frederick | Oct 23, 2025 | News

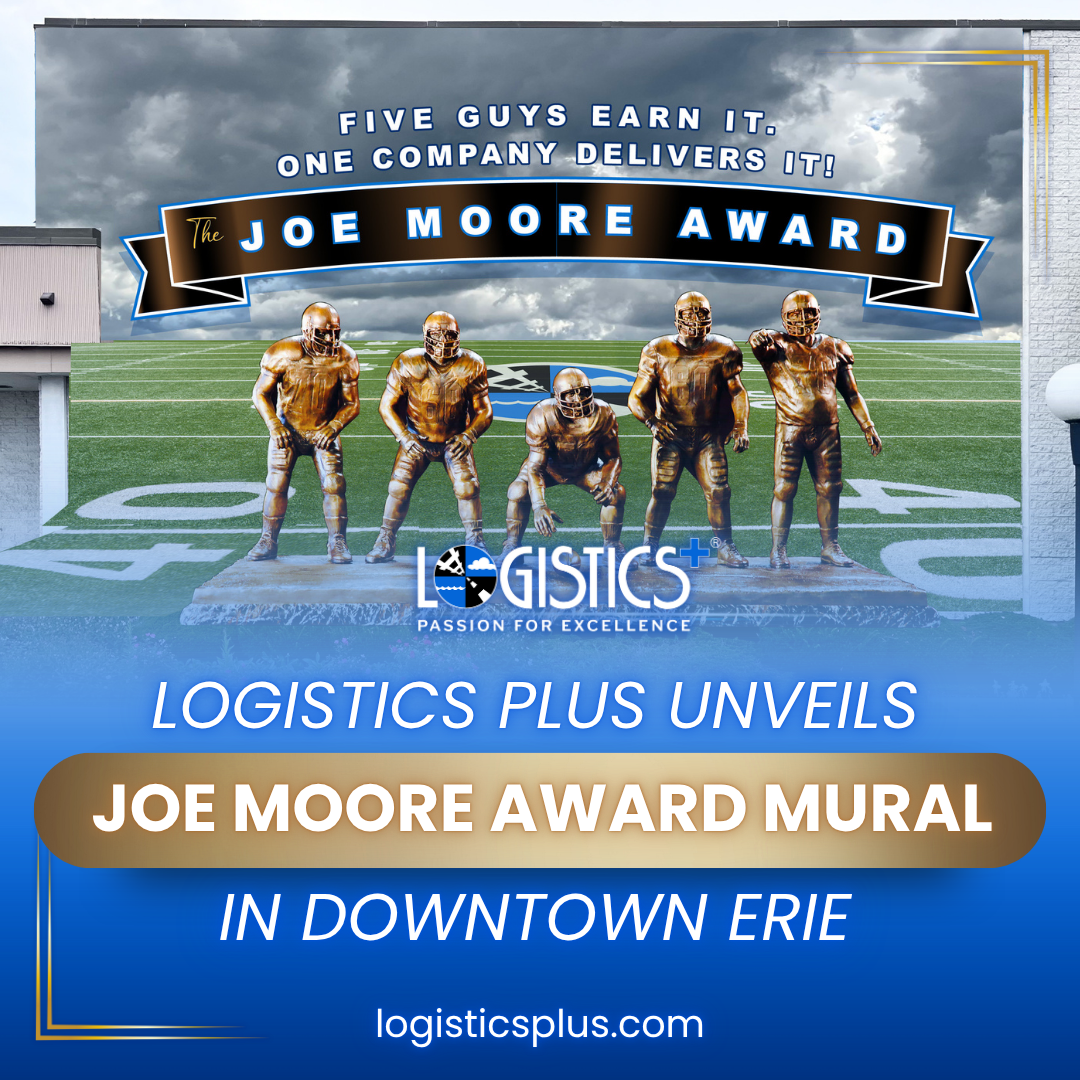

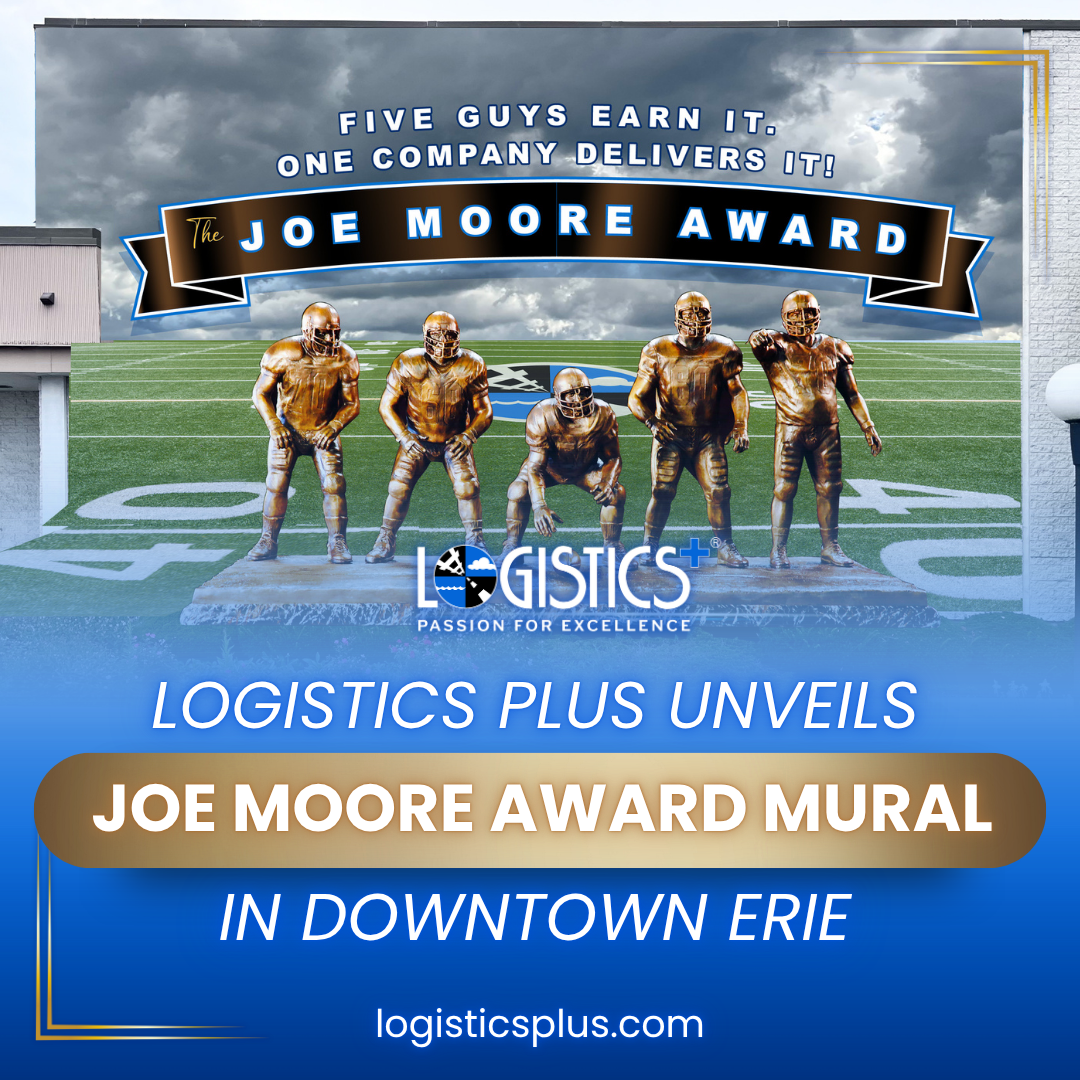

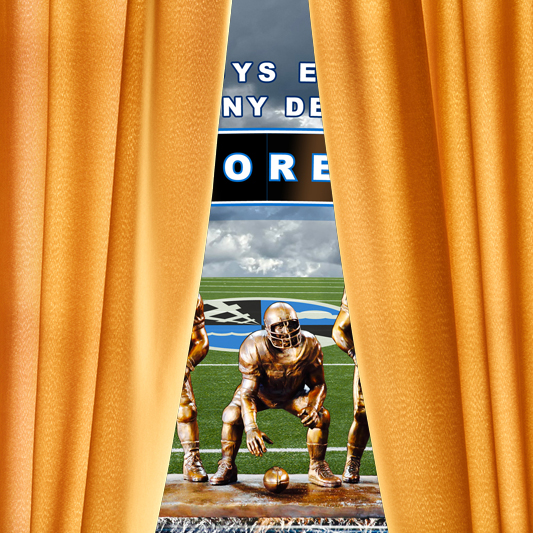

Logistics Plus Unveils Joe Moore Award Mural in Downtown Erie

Local artist Jason Mumford brings the national football honor to life on the Erie Times-News building.

ERIE, PA (October 23, 2025) – Logistics Plus, Inc. (LP), a global leader in transportation, logistics, and unique supply chain solutions, in partnership with local Erie muralist Jason Mumford and the Joe Moore Award (JMA) foundation, hosted a ceremony to officially unveil a new 25×40 foot, large-scale mural celebrating the prestigious Joe Moore Award, college football’s top honor for offensive linemen.

ERIE, PA (October 23, 2025) – Logistics Plus, Inc. (LP), a global leader in transportation, logistics, and unique supply chain solutions, in partnership with local Erie muralist Jason Mumford and the Joe Moore Award (JMA) foundation, hosted a ceremony to officially unveil a new 25×40 foot, large-scale mural celebrating the prestigious Joe Moore Award, college football’s top honor for offensive linemen.

The mural, painted on the side of the LP Erie Times-News building on 12th Street, showcases Erie’s connection to the national award, the legendary coach behind it, and adds to the city’s growing collection of public art. As announced earlier this year, Logistics Plus is the Exclusive Logistics Provider of the Joe Moore Award.

“It’s an honor to create something that connects Erie to a national story,” said muralist Jason Mumford. “I hope everyone who drives by this mural feels a sense of pride in Erie and what we can achieve together.”

“We love finding ways to give back to our hometown while celebrating the things that make Logistics Plus unique,” said Jim Berlin, Founder & CEO of Logistics Plus. “This mural captures the spirit of teamwork that defines the Joe Moore Award and our company. It’s a reminder that big things happen when people work together.”

Learn more about Logistics Plus and the Joe Moore Award at logisticsplus.com/joemooreaward.

Erie Times-News / GoErie.com provided some coverage of the event, which included legendary Bills quarterback Jim Kelly making an appearance.

https://www.goerie.com/story/sports/nfl/2025/10/23/pro-football-hall-of-famer-jim-kelly-in-erie-for-jes-speaker-series/86667286007/

The following photographs were taken at the event by rfrankmedia.com.

![Joe Moore Award Mural Event]()

About Logistics Plus, Inc.

Logistics Plus, Inc. is a 21st Century Logistics Company™. With annual global sales approaching $1 billion, Logistics Plus is a leading global provider of transportation, warehousing, fulfillment, logistics, project management, business intelligence, technology, and unique supply chain solutions. The company is recognized as one of the fastest-growing privately owned logistics companies, with a presence in over 50 countries worldwide. With its trademark Passion for Excellence™, Logistics Plus is consistently recognized as a great place to work and a top global logistics provider. Learn more at logisticsplus.com.

by Scott Frederick | Oct 16, 2025 | News

Logistics Plus to Host Unveiling Ceremony for the Joe Moore Award Mural in Downtown Erie

The ceremony will take place on Wednesday, October 22, 2025, at 5:15 pm at 205 West 12th Street.

ERIE, PA (October 16, 2025) – Logistics Plus, Inc. (LP), in partnership with local Erie muralist Jason Mumford and the Joe Moore Award (JMA) foundation, will host a ceremony to officially unveil a new large-scale mural celebrating the prestigious Joe Moore Award, college football’s top honor for offensive linemen. The mural, painted on the side of the LP Erie Times-News building on 12th Street, showcases Erie’s connection to the national award and adds to the city’s growing collection of public art. Logistics Plus is the Exclusive Logistics Provider of the Joe Moore Award.

WHO:

WHO:

• Jim Berlin, Founder & CEO, Logistics Plus

• Jason Mumford, Erie Muralist & Artist

• Special footbal guest

• Local officials and community leaders

• Logistics Plus employees

• Media representatives

WHEN:

October 22, 2025, at 5:15 pm EDT.

This is a rain-or-shine event. In the event of inclement weather, the dedication and remarks will be held indoors at the Logistics Plus Erie Times-News building (front lobby). Photos can then be taken once the skies clear.

WHERE:

Logistics Plus Erie Times-News Building

205 West 12th Street

Erie, PA 16501

WHY:

This new mural highlights Erie’s connection to this nationally recognized college football award and the legendary coach behind it, celebrates local artistry, and demonstrates LP’s continued commitment to investing in the Erie community.

VISUALS:

• Mural unveiling ceremony with community leaders

• The completed Joe Moore Award mural

• Time-lapse video of the mural painting

• Interviews with Jason Mumford and Jim Berlin

Learn more at logisticsplus.com/joemooreaward.

About Logistics Plus, Inc.

Logistics Plus, Inc. is a 21st Century Logistics Company™. With annual global sales approaching $1 billion, Logistics Plus is a leading global provider of transportation, warehousing, fulfillment, logistics, project management, business intelligence, technology, and unique supply chain solutions. The company is recognized as one of the fastest-growing privately owned logistics companies, with a presence in over 50 countries worldwide. With its trademark Passion for Excellence™, Logistics Plus is consistently recognized as a great place to work and a top global logistics provider. Learn more at logisticsplus.com.

by Scott Frederick | Oct 9, 2025 | News

Logistics Plus, a long-time member and logistics partner of The MBA (Manufacturer & Business Association), once again sponsored its premier annual event. The 120th Annual Event took place on Wednesday, October 8, 2025, at the Erie Bayfront Convention Center. Maxine Reyes performed the national anthem, and Dana Perino, former White House press secretary, co-anchor of America’s Newsroom, co-host of The Five, and bestselling author of multiple books, was the keynote speaker. Logistics Plus was again well-represented at the event, and Patrick Steele had the honor of taking the stage when The MBA recognized the evening’s premier sponsors. Patrick is a member of The MBA’s newly created Next Gen Advisory Board.

A complete photo album can be found on Flickr at https://www.flickr.com/photos/manp/.

A great interview with Dana Perino can be found on The MBA Business Magazine website at http://www.mbabizmag.com/2025/10/01/resilient-leadership-in-divided-times-lessons-from-the-white-house-cable-news-and-a-life-unscripted-2/.

by Scott Frederick | Oct 2, 2025 | News

Logistics Plus and Kingston Wharves Announce Partnership to Support FF&E Hospitality Projects in Jamaica

The combined expertise of both companies will ensure these projects are executed seamlessly, efficiently, and on time.

ERIE, PA (October 2, 2025) – Logistics Plus, Inc. (LP), a global leader in transportation, logistics, and unique supply chain solutions, today announced a new partnership with Kingston Wharves Limited (KWL) to support furniture, fixtures, and equipment (FF&E) for hospitality projects throughout Jamaica.

ERIE, PA (October 2, 2025) – Logistics Plus, Inc. (LP), a global leader in transportation, logistics, and unique supply chain solutions, today announced a new partnership with Kingston Wharves Limited (KWL) to support furniture, fixtures, and equipment (FF&E) for hospitality projects throughout Jamaica.

Jamaica continues to encourage and promote new hotel construction and renovations to strengthen its tourism industry. Logistics Plus, Inc. and Kingston Wharves Limited are spearheading efforts to support diverse hospitality properties, helping to elevate Jamaica’s position as a world-class business and tourism destination.

Through this new collaboration, Logistics Plus and Kingston Wharves will combine their expertise to ensure that owners, investors, and their representatives are assured that these projects are executed seamlessly, efficiently, and on time.

Logistics Plus will leverage its global project experience — including successful FF&E logistics programs in the United States, Europe, and Hawaii – to coordinate supplier sourcing, international transportation, and the collection of items from global manufacturers. Kingston Wharves Limited, with extensive experience in port-centric logistics, will provide vital in-country services including warehousing, inventory management, and order fulfillment. Kingston Wharves Limited is now a recognized agent for Logistics Plus in Jamaica, further strengthening the company’s growing global network.

“This partnership brings together world-class expertise at a pivotal time for Jamaica’s growing hospitality sector,” said Yuriy Ostapyak, COO of Logistics Plus. “By combining our global logistics capabilities with the local knowledge and trusted services of Kingston Wharves, hospitality asset owners and developers will have a single, reliable solution to manage complex FF&E projects from start to finish.”

According to KWL CEO Mark Williams: “Kingston Wharves has closely observed the continued expansion of tourism along Jamaica’s North Coast, particularly in hotel development, and recognizes the potential of these projects to further stimulate economic growth for the country. This joint venture with Logistics Plus—an internationally recognized and world-class specialist in FF&E for the hospitality industry—underscores our commitment to supporting national development while also reinforcing Montego Bay’s pivotal role in Jamaica’s logistics sector.”

Other key leaders on the Logistics Plus side of the new partnership include Anthony Akerman, Global Director, Bruce Navarro, Commercial Director, and Frank Knafelz, Senior Vice President.

About Kingston Wharves Limited

Kingston Wharves Limited (KWL) is the leading multipurpose port terminal operator and logistics provider in the Caribbean, boasting decades of experience. The company has strong connections to the hospitality industry and plans to leverage its partnership with Cargo Handlers Limited, based in Montego Bay, which has extensive expertise in hospitality logistics and supply chain management. KWL’s unique experience and synergies position it well to support hotel furniture, fixtures, and equipment (FF&E) and logistics projects throughout the island. Learn more at kingstonwharves.com.

About Logistics Plus, Inc.

Logistics Plus, Inc. is a 21st Century Logistics Company™. With annual global sales approaching $1 billion, Logistics Plus is a leading global provider of transportation, warehousing, fulfillment, logistics, project management, business intelligence, technology, and unique supply chain solutions. The company is recognized as one of the fastest-growing privately owned logistics companies, with a presence in over 50 countries worldwide. With its trademark Passion for Excellence™, Logistics Plus is consistently recognized as a great place to work and a top global logistics provider. Learn more at logisticsplus.com.

by Scott Frederick | Sep 23, 2025 | News

Logistics Plus Renews Its U.S. EPA SmartWay® Partnership for a 15th Year

Logistics Plus ranks among the top SmartWay Partners in carbon emissions per mile.

ERIE, PA (September 23, 2025) – Logistics Plus, Inc. (LP), a global leader in transportation, logistics, and unique supply chain solutions, is proud to announce that, for a fifteenth straight year, it has submitted and received approval for its current data submission to the SmartWay Partnership, an innovative collaboration between the U.S. Environmental Protection Agency (EPA) and the industry.

ERIE, PA (September 23, 2025) – Logistics Plus, Inc. (LP), a global leader in transportation, logistics, and unique supply chain solutions, is proud to announce that, for a fifteenth straight year, it has submitted and received approval for its current data submission to the SmartWay Partnership, an innovative collaboration between the U.S. Environmental Protection Agency (EPA) and the industry.

Since 2004, SmartWay has helped its 4,000+ partners save 397 million barrels of oil- equivalent to eliminating annual electricity use in over 26 million homes. By helping America’s freight industry reduce its dependence on foreign fuel, we can invest more dollars at home and reduce our national trade deficit. Based on the most currently available 2023 rankings, Logistics Plus ranks among the top partners for the lowest CO2 emissions per mile among the 4,531 active SmartWay partners.

About SmartWay

SmartWay is a market-driven initiative that empowers businesses to move freight in the cleanest, most energy-efficient way possible. It provides shippers and carriers with the tools and support they need to track, document, and share information about transport modes, equipment, and operational strategies that can reduce fuel use and emissions across the supply chain. For information about the SmartWay, visit www.epa.gov/smartway.

About Logistics Plus, Inc.

Logistics Plus, Inc. is a 21st Century Logistics Company™. With annual global sales approaching $1 billion, Logistics Plus is a leading global provider of transportation, warehousing, fulfillment, logistics, project management, business intelligence, technology, and unique supply chain solutions. The company is recognized as one of the fastest-growing privately owned logistics companies, with a presence in over 50 countries worldwide. With its trademark Passion for Excellence™, Logistics Plus is consistently recognized as a great place to work and a top global logistics provider. Learn more at logisticsplus.com.

ERIE, PA (October 23, 2025) – Logistics Plus, Inc. (LP), a global leader in transportation, logistics, and unique supply chain solutions, in partnership with local Erie muralist Jason Mumford and the Joe Moore Award (JMA) foundation, hosted a ceremony to officially unveil a new 25×40 foot, large-scale mural celebrating the prestigious Joe Moore Award, college football’s top honor for offensive linemen.

ERIE, PA (October 23, 2025) – Logistics Plus, Inc. (LP), a global leader in transportation, logistics, and unique supply chain solutions, in partnership with local Erie muralist Jason Mumford and the Joe Moore Award (JMA) foundation, hosted a ceremony to officially unveil a new 25×40 foot, large-scale mural celebrating the prestigious Joe Moore Award, college football’s top honor for offensive linemen.

ERIE, PA (October 2, 2025) – Logistics Plus, Inc. (LP), a global leader in transportation, logistics, and unique supply chain solutions, today announced a new partnership with Kingston Wharves Limited (KWL) to support furniture, fixtures, and equipment (FF&E) for hospitality projects throughout Jamaica.

ERIE, PA (October 2, 2025) – Logistics Plus, Inc. (LP), a global leader in transportation, logistics, and unique supply chain solutions, today announced a new partnership with Kingston Wharves Limited (KWL) to support furniture, fixtures, and equipment (FF&E) for hospitality projects throughout Jamaica.