HTS Code Classification

Logistics Plus® can help you properly assign HTS (Harmonized Tariff Schedule) codes for your products.Correctly assign your HTS codes.

Improper HTS code classification can result in fines and penalties imposed by the U.S. Customs and Border Protection. Logistics Plus has a staff of licensed customs brokers that can help you classify correct HTS (Harmonized Tariff Schedule) codes for your products.

We can classify your products from scratch, or provide a second set of eyes on your current HTS code classification(s). No matter if your company has five unique products or 50,000 products, Logistics Plus will ensure that all of your HTS codes are properly classified.

Logistics Plus HTS Code Classification

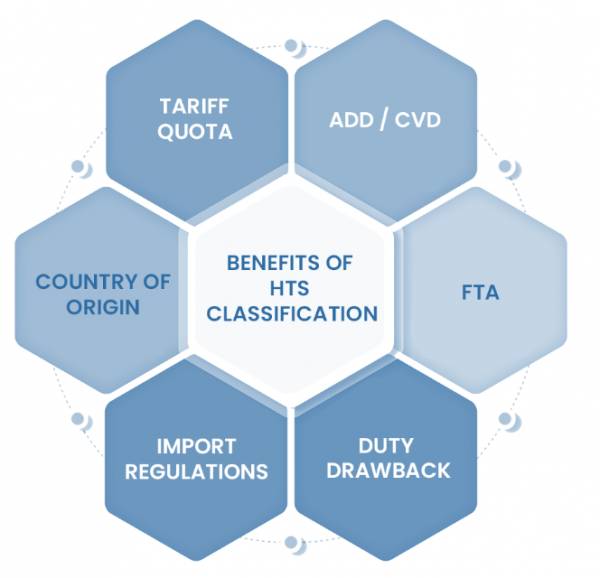

HTS classifications determine:

- Admissibility into customs territory

- Duties owed

- Quotas and content requirements

- Special trade program eligibility

- Anti-dumping and countervailing duties

- Product based import sanctions

- Other government agency requirements

How can we help?

All we need is a listing of all the SKU’s to be classified along with access to your product literature and technical specifications. We then classify each SKU and provide the classifications back to you either electronically via Excel or make them available to you using our online interface.

How much does this service cost?

We charge per SKU and provide volume discounts. The more products you need classified, the less your per SKU price.

Ready to get started?

Contact us today for more information. When it comes to customs and global trade compliance, our experts will guide you through the complexities during each step of the process.

Customs & Compliance Team

Email: cbs@logisticsplus.com

**Please note: Due to liability concerns, we DO NOT handle personal effects or household goods.**