by logisticsplus | Aug 16, 2017 | News

Logistics Plus recently recorded two new webinars as part of its ongoing series of complimentary logistics-related webinars for the Manufacturer & Business Association (MBA) and its members. The two new webinars are focused on Importing Basics and Exporting Basics. Although these webinars are prepared for the benefit of MBA members, the informational content is appropriate for any business that is, or will be, importing or exporting products. Past webinars cover additional transportation and logistics topics. Logistics Plus is the company that manages the MBA Logistics Program. You can learn more about the program at www.mbausa.org/logistics.

Logistics Plus recently recorded two new webinars as part of its ongoing series of complimentary logistics-related webinars for the Manufacturer & Business Association (MBA) and its members. The two new webinars are focused on Importing Basics and Exporting Basics. Although these webinars are prepared for the benefit of MBA members, the informational content is appropriate for any business that is, or will be, importing or exporting products. Past webinars cover additional transportation and logistics topics. Logistics Plus is the company that manages the MBA Logistics Program. You can learn more about the program at www.mbausa.org/logistics.

Importing Basics:

Exporting Basics:

by Marketing | Jul 11, 2017 | News

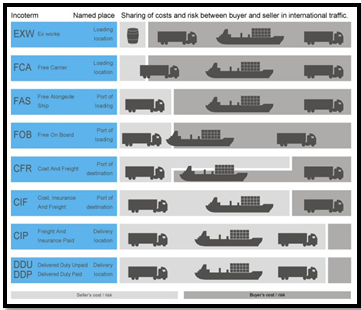

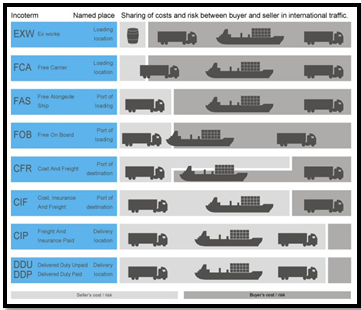

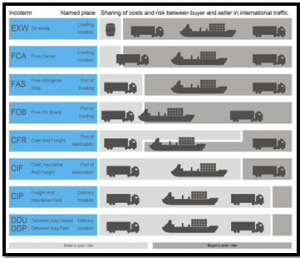

Incoterms® is an abbreviation for “International Commercial Terms.” This term represents a very useful way of communication and it’s actually aimed at reducing confusion between buyers and sellers.

Incoterms® is an abbreviation for “International Commercial Terms.” This term represents a very useful way of communication and it’s actually aimed at reducing confusion between buyers and sellers.

So what is an incoterm? An incoterm represents a universal term that defines a transaction between importer and exporter so that both parties understand the tasks, costs, risks, and responsibilities, as well as the logistics and transportation management from the exit of the product to the reception by the importing country. Incoterms are all the possible ways of distributing responsibilities and obligations between two parties. It is important for the buyer and seller to pre-define the responsibilities and obligations for the transport of the goods.

Here are the main responsibilities and obligations:

- Point of delivery: here, the incoterms defines the point of change of hands from seller to buyer.

- Transportation costs: here, the incoterms define who pays for whichever transportation is required.

- Export and import formalities: here, incoterms define which party arranges for import and export formalities.

- Insurance cost: here, incoterms define who takes charge of the insurance cost.

Advantages of using incoterms:

- As they stand today, there are 11 main terms and a number of secondary terms that help buyers and sellers communicate the provisions of a contract in a clearer way; therefore, reducing the risk of misinterpretation by one of the parties.

- Incoterms govern everything from transportation costs, insurance to liabilities. They contribute to answering questions such as “When will the delivery be completed?” “What are the modalities and conditions for transportation?” and “How do you ensure one party that the other has met the established standards? Having said that, it is important to remember that there are also limits to Incoterms. For example, they do not apply to contractual rights and obligations that do not have to do with deliveries. Neither do they define solutions for breach of contract.

Here’s what you should know about incoterms:

- Ex Works (EXW) – The seller makes the goods available at its location, so the buyer can take over all the transportation costs and also bears the risks of bringing the goods to their final destination.

- Free Carrier (FCA) – The seller hands over the goods into the disposal of the first carrier. After the buyer takes over all the costs, the risk passes when the goods are handed over to the first carrier.

- Free Alongside Ship (FAS) – The seller must place the goods alongside the ship at the named port, the risk of loss or damage to the goods passes when the goods are alongside the ship, and the buyer bears all the costs from that moment on.

- Free on Board (FOB) –The seller must load the goods on board of the ship, nominated by the buyer. Cost and risk are divided when the goods are actually on board.

- Cost and Freight (CFR) –Seller must pay the costs and freight to bring the goods to the port of destination. Although the risk is transferred to the buyer when the goods are loaded on the ship.

- Cost, Insurance and Freight (CIF) –It’s exactly like CFR except that the seller must in addition procure and pay for the insurance.

- Carrier and Insurance Paid to (CIP) –The seller pays for the carriage and insurance to the named destination point, but risk passes when the goods are handed over to the first carrier.

- Delivered Duty Paid (DDP) –The seller is responsible for delivering the goods to the named place in the country of the buyer, and pays all costs in bringing the goods to the destination.

You will find a handy Incoterms 2010 Quick Reference Guide on the Logistics Plus website. Additionally, you can check out our short Introduction to Incoterms 2010 Webinar online.

by Marketing | Jun 6, 2017 | News

Shipping between the U.S. and Mexico is not as easy as it may seem. In order to transport shipments between these countries, there are certain regulations and documents that must be legally followed. The most common methods of shipping goods from the United States to Mexico are by truck, rail, air and sea, or a mixture of two or more of these transportation modes.

Shipping between the U.S. and Mexico is not as easy as it may seem. In order to transport shipments between these countries, there are certain regulations and documents that must be legally followed. The most common methods of shipping goods from the United States to Mexico are by truck, rail, air and sea, or a mixture of two or more of these transportation modes.

Here’s what you need to know when you’re shipping from the U.S. to Mexico:

- An American carrier will transport your cargo to the border and deliver it to the designated carrier who has been selected / hired by the Mexican consignee (the recipient of his goods).

- The carrier receives your shipment, inspects the cargo, checks all documents and prepares the shipment to enter Mexico on behalf of the Mexican customs agent who is handling your shipment.

- The Mexican customs agent will formally present the Mexican customs entry on behalf of the Mexican consignee.

- Now it’s time for your cargo to cross the border! A third party transportation company will ship your shipment across the border, through customs, and then deliver it to the selected Mexican carrier’s facility.

- Finally, the Mexican carrier transports its cargo inland to its final destination in Mexico, the consignee

Here’s what you need to know when you’re shipping from Mexico to the U.S:

- A Mexican carrier transports its cargo to the border city.

- A Mexican customs agent formally presents the entry of the Mexican export customs on behalf of the Mexican sender so that the goods can legally leave the country.

- A licensed U.S. customs agent then files the U.S. customs clearance so that the shipment can enter the U.S. on behalf of the U.S. importer of record (the consignee).

- A third party transportation company will ship your shipment across the border, through the U.S. Customs, and deliver the shipment to the selected U.S. carrier’s premises.

- The U.S. carrier transports the freight to the final destination.

Here are the basic import and export documents you’ll need:

- Import /export form

- Commercial invoice

- Bill of lading

- NAFTA Certificate of Origin (only if goods qualify for NAFTA)

Every country has its own regulations and shipping requirements so it’s important to be aware of this information before shipping to any country. Contact our team of cross-border experts here at Logistics Plus to learn more about shipping between the U.S and Mexico.

by logisticsplus | Apr 13, 2017 | News

The folks at Inbound Logistics magazine published their 13th annual Global Logistics Guide in the March 2017 issue. You can also read the full report online. As part of the report, Inbound Logistics ranks major foreign countries according to the following criteria:

The folks at Inbound Logistics magazine published their 13th annual Global Logistics Guide in the March 2017 issue. You can also read the full report online. As part of the report, Inbound Logistics ranks major foreign countries according to the following criteria:

- Transportation infrastructure (T)

- IT competency (I);

- Business culture (B); and

- Intangibles (X).

For your benefit, we have summarized the Inbound Logistics rankings below (10 is the highest score and 3 is the lowest):

| Region |

Country |

Overall |

T |

I |

B |

X |

| Europe |

Netherlands |

10 |

4 |

3 |

3 |

0 |

| Europe |

Germany |

9 |

4 |

3 |

2 |

0 |

| ME/Africa |

UAE |

9 |

4 |

2 |

2 |

1 |

| SE Asia/India |

Singapore |

9 |

4 |

3 |

2 |

0 |

| Europe |

Switzerland |

8 |

3 |

3 |

2 |

0 |

| Asia |

Hong Kong |

8 |

3 |

3 |

2 |

0 |

| Asia |

Japan |

8 |

3 |

3 |

2 |

0 |

| Americas |

Canada |

7 |

2 |

3 |

3 |

-1 |

| Americas |

Panama |

7 |

3 |

1 |

2 |

1 |

| Europe |

France |

7 |

3 |

2 |

2 |

0 |

| Europe |

Belgium |

7 |

3 |

2 |

2 |

0 |

| SE Asia/India |

Malaysia |

7 |

3 |

2 |

2 |

0 |

| SE Asia/India |

India |

7 |

2 |

1 |

2 |

2 |

| SE Asia/India |

Taiwan |

7 |

3 |

3 |

2 |

-1 |

| Asia |

South Korea |

7 |

3 |

3 |

2 |

-1 |

| Americas |

Chile |

6 |

2 |

2 |

2 |

0 |

| Europe |

Poland |

6 |

2 |

1 |

2 |

1 |

| Asia |

China |

6 |

3 |

1 |

2 |

0 |

| Americas |

Colombia |

5 |

2 |

1 |

2 |

0 |

| Americas |

Mexico |

4 |

2 |

1 |

2 |

-1 |

| Europe |

Russia |

4 |

2 |

1 |

1 |

0 |

| SE Asia/India |

Indonesia |

4 |

2 |

1 |

1 |

0 |

| SE Asia/India |

Thailand |

4 |

2 |

1 |

1 |

0 |

| Asia |

Vietnam |

4 |

2 |

1 |

1 |

0 |

| Americas |

Brazil |

3 |

2 |

1 |

1 |

-1 |

| Europe |

Turkey |

3 |

2 |

1 |

1 |

-1 |

| ME/Africa |

South Africa |

3 |

2 |

1 |

1 |

-1 |

The good news is that if you are exporting to, or importing from, any of these countries, Logistics Plus has local offices or reliable agents in almost every one of these countries. So we can help you with affordable import/export transportation rates and customs clearance fees; we can help you with warehousing and distribution solutions if they’re needed; and we can help you address virtually any global trade compliance issue that might apply. If you do business in any of these countries, we invite you to contact us to learn more.

by logisticsplus | Nov 15, 2016 | News

Here are a few quick, cost-saving tips for importing and exporting from the international air, international ocean, and project cargo freight forwarding experts at Logistics Plus:

Here are a few quick, cost-saving tips for importing and exporting from the international air, international ocean, and project cargo freight forwarding experts at Logistics Plus:

Importing Tips:

- Take the time to confirm your HTS codes before importing. U.S. Customs’ system of classification can be very complicated, and the HTS codes advised by suppliers are not always accurate or match the U.S. classification system 100%. A full cost for imported goods can only be known with the correct HTS codes.

- Keep potential exams in mind when thinking about the transit time, for ocean shipments particularly. An exam can take a week or more, and could be caused by any importer on an LCL consolidation, or a container could be simply selected at random. If goods are time-sensitive, air shipping part or all of the order could save money in the long run.

- Be sure your broker or import forwarder is made aware of all ocean imports well in advance of departure from overseas. An Importer Security Filing (ISF) must be filed timely! Liquidated damages for ISF start at $5,000 for failure to file an ISF, $5,000 for late ISF, $5,000 for inaccurate ISF, $5,000 for an incomplete ISF, and $5,000 for failure to withdraw an ISF. The maximum liquidated damages per ISF filing is $10,000.

Exporting Tips:

- Know your Incoterms®. Incoterms can be a frustrating and confusing to understand; however many exporters do not fully understand the terms to which they are agreeing and, therefore, end up paying more or running into unexpected fees. As an exporter, you need to understand the costs, responsibilities, rights, and obligations that accompany the use of a specific Incoterm. Every quotation or sales order must include a term of sale. If you fail to clearly identify the specific Incoterm to your customer, it can lead to an overestimation or underestimation of the costs associated with the goods you are selling (and a lost sale).

- Research the area to which you are selling. Selling to a new area requires you to keep an open mind. Knowing the market you will be putting your product into can alleviate a lot of the stress with exporting. What currency do they use? What is the local tax or VAT (value-added tax) system? What is the business culture, and/or local culture? When are their holidays or weekends observed?

- Do your paperwork. Know that each country has its own set of importing regulations that require different licenses and customs paperwork. Some countries will require certain stamping, legalizations, or original documents, while others simply accept copies. These vary from country to country, region to region, and with specific commodities.

Most Important Tip:

- Work with an experienced and reputable freight forwarder. An international freight forwarder acts as an agent on your behalf and assists in moving your shipment from its U.S. origin to its foreign destination. Capable freight forwarders are familiar with the import rules and regulations of foreign countries, U.S. import and export regulations, methods of shipping, and required documentation. They can assist you in preparing pricing quotations by providing freight costs, port charges, documentation fees, insurance costs, and handling fees. They can also recommend packaging methods and transportation modes that will best protect your products during transport and ensure they arrive when and where you need them.

Ready to take us up on tip #7? If yes, then click the button below to get started.

Logistics Plus recently recorded two new webinars as part of its ongoing series of complimentary logistics-related webinars for the Manufacturer & Business Association (MBA) and its members. The two new webinars are focused on Importing Basics and Exporting Basics. Although these webinars are prepared for the benefit of MBA members, the informational content is appropriate for any business that is, or will be, importing or exporting products. Past webinars cover additional transportation and logistics topics. Logistics Plus is the company that manages the MBA Logistics Program. You can learn more about the program at www.mbausa.org/logistics.

Logistics Plus recently recorded two new webinars as part of its ongoing series of complimentary logistics-related webinars for the Manufacturer & Business Association (MBA) and its members. The two new webinars are focused on Importing Basics and Exporting Basics. Although these webinars are prepared for the benefit of MBA members, the informational content is appropriate for any business that is, or will be, importing or exporting products. Past webinars cover additional transportation and logistics topics. Logistics Plus is the company that manages the MBA Logistics Program. You can learn more about the program at www.mbausa.org/logistics.