by logisticsplus | Oct 3, 2017 | News

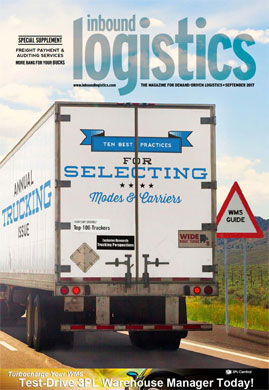

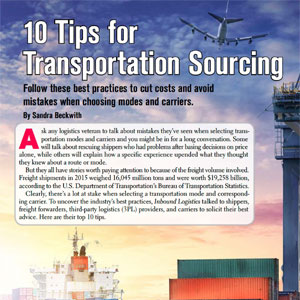

Logistics Plus recently participated in an interview with Inbound Logistics magazine to provide tips on transportation sourcing. The interview was with Jeremy Chaffee who is the director of domestic operations for Logistics Plus. The print version of the magazine article also featured a couple of Logistics Plus photographs. The article was written by Sandra Beckwith and you can read the online version of the article on the Inbound Logistics website using the link below.

10 Tips for Transportation Sourcing

A PDF excerpt of the article can also be downloaded and viewed by clicking the image below.

Contact Logistics Plus if you’d like our help managing transportation sourcing needs.

by logisticsplus | Aug 7, 2017 | News

As a reminder, the recently approved National Motor Freight Classification (NMFC) freight classification changes went into effect this weekend (August 5th, 2017). These changes will have far-reaching effects on LTL shipments of certain commodities in the NMFC that are based on density ratings, such as Plastic or Rubber Articles, Expanded, NOI (157320), and others. Previously, most items assigned a class based on density were subject to one of two tables. The so-called 9-tier classification broke down density into 9 sub ratings as follows:

As a reminder, the recently approved National Motor Freight Classification (NMFC) freight classification changes went into effect this weekend (August 5th, 2017). These changes will have far-reaching effects on LTL shipments of certain commodities in the NMFC that are based on density ratings, such as Plastic or Rubber Articles, Expanded, NOI (157320), and others. Previously, most items assigned a class based on density were subject to one of two tables. The so-called 9-tier classification broke down density into 9 sub ratings as follows:

| Sub 1 |

Less than 1 |

400 |

| Sub 2 |

1 but less than 2 |

300 |

| Sub 3 |

2 but less than 4 |

250 |

| Sub 4 |

4 but less than 6 |

150 |

| Sub 5 |

6 but less than 8 |

125 |

| Sub 6 |

8 but less than 10 |

100 |

| Sub 7 |

10 but less than 12 |

92.5 |

| Sub 8 |

12 but less than 15 |

85 |

| Sub 9 |

15 or greater |

70 |

The 11-tier classification contained 11 density breakdowns:

| Sub 1 |

Less than 1 |

400 |

| Sub 2 |

1 but less than 2 |

300 |

| Sub 3 |

2 but less than 4 |

250 |

| Sub 4 |

4 but less than 6 |

150 |

| Sub 5 |

6 but less than 8 |

125 |

| Sub 6 |

8 but less than 10 |

100 |

| Sub 7 |

10 but less than 12 |

92.5 |

| Sub 8 |

12 but less than 15 |

85 |

| Sub 9 |

15 but less than 22.5 |

70 |

| Sub 10 |

22.5 but less than 30 |

65 |

| Sub 11 |

30 or greater |

60 |

Effective August 5th, the 9-tier breakdown will go away and NMFC items subject to it will be replaced by the 11 tier breakdown. This change is actually good news for shippers, as it provides for a lower class for shipments that are very dense, specifically over 22.5 lbs per cubic foot. The other change however is not so favorable. The 11-tier breakdown will change the sub 4 rating for articles that have a density of 4 but less than 6 pounds per cubic foot. Previously this was rated as a class 150, but will now be rated at a class 175:

For shippers whose LTL shipments were previously rated at class 150 based on density and will now be rated at class 175, this represents about a 15% increase in freight rates. For shippers with an FAK rating of 150, this should not change that rating, but items that were previously in the actual class range may now change. For example, if a shipper has a FAK class 100 rating on items with an actual class of 100-150, and they ship Plastic Articles with a density of 4-6 pcf, this shipment will no longer be subject to the FAK class 100 and will instead move at the actual class of 175.

For shippers whose LTL shipments were previously rated at class 150 based on density and will now be rated at class 175, this represents about a 15% increase in freight rates. For shippers with an FAK rating of 150, this should not change that rating, but items that were previously in the actual class range may now change. For example, if a shipper has a FAK class 100 rating on items with an actual class of 100-150, and they ship Plastic Articles with a density of 4-6 pcf, this shipment will no longer be subject to the FAK class 100 and will instead move at the actual class of 175.

Please contact your Logistics Plus North American Division (NAD) freight representative if you have any questions regarding the new rules.

by logisticsplus | Jul 20, 2017 | News

Carrier liability and cargo insurance (also known as shippers’ interest) are often thought to be the same thing. Although they both involve certain coverage of freight, they have some key differences that are important to understand. Damaged and lost items are unfortunately a common problem when shipping freight. Because of this, it is crucial to know how to get the best coverage on all of your shipments. Here are some of the key differences between carrier liability and cargo insurance:

Carrier Liability

All freight shipments come with some sort of “limited liability coverage.” This coverage is determined by the carrier and varies depending on the commodity type or freight class of the goods being shipped. For the most part, carrier liability covers up to a certain dollar amount per pound of freight. It is not uncommon to find that the included liability coverage is less than the actual value of the goods being shipped. Also, if the freight is used and not directly from the manufacturer, the liability coverage will be significantly less than it would be for new goods. Furthermore, carrier liability has limitations in certain instances when the damage is due to an act of God (weather-related), or act of the shipper (improper packaging or loading). In these two cases, the carrier cannot be at fault.

Cargo Insurance

Shippers’ interest cargo insurance, also sometimes referred to as freight insurance or goods-in-transit insurance, is a great way to protect customers from lost or damaged freight while it is being transported. This insurance is an additional charge that is typically based on the value of the goods being shipped. As previously mentioned, carrier liability may only cover a certain dollar amount per pound of freight. When your freight has a higher value than what is covered by liability, cargo insurance may be very beneficial to you in order to better protect yourself from lost or damaged cargo. Another benefit of purchasing cargo insurance is that you do not need to prove the carrier was at fault for the lost or damaged items, only that the damage or loss actually occurred.

Differences in the Claims Process

If the shipment is only covered by carrier liability:

- The freight claim must be filed within 9 months of delivery

- If the delivery receipt isn’t noted as damaged some carriers require immediate notification

- Proof of value and proof of loss must be provided

- The carrier has 30 days to acknowledge the claim and must respond within 120 days

- You must prove carrier negligence (the freight was picked up in good order and packaged properly, but was delivered in a damaged condition)

If the shipment is covered by shippers’ interest cargo insurance:

- You must provide proof of value and proof of loss

- Claims are usually paid within 30 days

- You aren’t required to prove carrier negligence

Logistics Plus can help assist you in determining a carrier’s limited liability amount and deciding what coverage is best for your freight shipments. We also provide very affordable and comprehensive cargo insurance to shippers who need the added protection. Contact us today to learn more!

by Marketing | Jul 19, 2017 | News

Shipping freight may seem like a very complex process due to the number of options available. It’s important to understand the differences between Full Truckload (FTL) shipping and Less Than Truckload (LTL) shipping because they are two of the most commonly used transportation options within North America. Shippers must consider size, speed, and price when deciding between a FTL versus LTL. Here are the main differences between FTL and LTL shipments to help you decide which shipping method works best for you.

Shipping freight may seem like a very complex process due to the number of options available. It’s important to understand the differences between Full Truckload (FTL) shipping and Less Than Truckload (LTL) shipping because they are two of the most commonly used transportation options within North America. Shippers must consider size, speed, and price when deciding between a FTL versus LTL. Here are the main differences between FTL and LTL shipments to help you decide which shipping method works best for you.

The main differences between FTL and LTL shipments can be broken down into four categories:

Size

The first thing you must take into consideration when shipping freight is the size. The names Full Truckload and Less Than Truckload are self-explanatory and mean exactly what they say. LTL shipments are smaller shipments typically ranging from 100 to 5,000 pounds. These smaller shipments will not fill an entire truck, leaving space for other small shipments. On the other hand, FTL shipments fill most to all of an entire truck and tend to be much larger, often weighing 20,000 pounds or more. Shipments that weigh between approximately 5,000 and 10,000 pounds can sometimes move either LTL or FTL. When such shipments move LTL, they are often referred to as “volume LTL” shipments; and when they move FTL, they are often referred as “partial TL” shipments (read more about Volume LTL and Partial TL here).

Price

Since LTL shipments are smaller and leave room for other shipments, they are cheaper because you will only pay for the space that you use. FTL shipments use most of the entire truck and cost more because you are paying for more space in the truck. The decision between choosing a FTL or LTL is crucial because if you choose the wrong option, you may end up paying for space that you aren’t even using.

Time

If you are pressed on time and need to have something shipped quickly, FTL may be the way to go. Since LTL shipments involve more than just your shipment, they often require multiple stops and transfers before they reach the final destination. Typically, FTL shipments pick up and deliver on the same truck leading to a quicker delivery time.

Handling

Along with how quickly you need a shipment to go out, you must also consider how delicate or high-risk the shipment is. With FTL shipping, your shipment will stay on the same truck and will not be transferred anywhere else. This creates less risk of damaged or missing items when shipping FTL. On the other hand, LTL shipments may switch trucks or be transferred multiple times before delivery, increasing the risk of damaged or missing items.

Choosing the correct shipping method is crucial for saving time and money for your company. If you have LTL or FTL shipping needs, then look no further than Logistics Plus! Contact us today.

by Marketing | Jun 27, 2017 | News

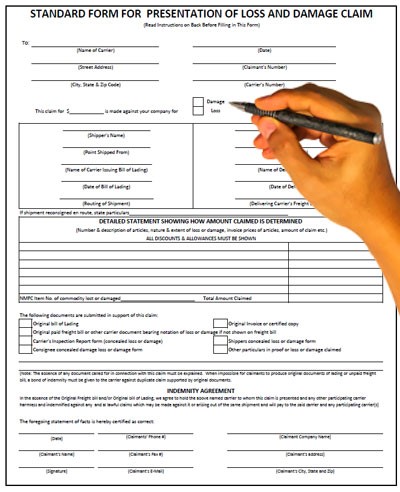

Learning how to effectively file a freight claim is important because it will save time and money for your company. A freight claim is a legal demand for the payment of money, stemming from the breach of a contract of carriage. Following specific guidelines and processes is the only way to correctly deal with these claims. There are four essential elements to filing a freight claim:

Learning how to effectively file a freight claim is important because it will save time and money for your company. A freight claim is a legal demand for the payment of money, stemming from the breach of a contract of carriage. Following specific guidelines and processes is the only way to correctly deal with these claims. There are four essential elements to filing a freight claim:

- The shipment must be identified so the carrier can complete an investigation.

- The type of loss or damage must be stated.

- The amount for the claim must be stated.

- A demand for payment by the carrier must be included.

On top of making sure all four elements are included, follow these tips and suggestions to make sure you effectively file your next freight claim:

- Take immediate action

- Taking immediate action is a crucial step of effectively filing a freight claim. Freight claims for loss or damage are generally governed by Title 49, CFR. Claimants must file the claim, in writing, within the time limits specified in the bill of lading or contract of carriage. The time period cannot be more than 9 months (49 USC 14706e) from date of delivery or, if never delivered, the expected delivery date. Unless otherwise agreed upon in a contract, a carrier must acknowledge receipt of a claim within 30 days. The carrier must then pay, offer to compromise or disallow the claim within 120 days or provide status reports every 60 days thereafter. If the carrier fails to abide by these periods, it should be notified that it is violating the FMCSA claim regulations. Furthermore, per the National Motor Freight Traffic Association, concealed damage must be reported to the carrier within 5 days. After 5 days, if the carrier has not been alerted of the damage, they retain the right to deny the claim. The customer then becomes responsible for providing proof that the damaged or missing items were the result of poor actions on behalf of the carrier. If the customer is unable to provide such proof, the claim will be considered invalid.

- Attempt to mitigate the damages

- A responsibility that all parties of the shipping process share is attempting to mitigate damages. It is your responsibility to give a good faith effort to salvage damaged products unless you consider them to be totally or substantially useless and of no good.

- Make supporting documentation available

- Including supporting documentation is necessary for correctly filing a freight claim. If available, you should include the original bill of lading (BOL), the paid freight bill, inspection reports, notification of loss, copies of request for inspection, invoices, waivers, and other appropriate documents such as temperature reports and weight certificates. The more information you have regarding the freight, the more effective your claim will be.

- Create a detailed description of the losses or damages

- A detailed description of the loss or damage should be properly displayed. The claimant should include the number of items damaged, the type of damage, the value of each unit, and the net loss which results in the total amount of the claim. For example:

- 15 boxes of cell phones – (water damaged) @ $500 each: $7,500

- 5 boxes of cell phone cases – (crushed) @ $100 each: $500

- Total Damages: $8,000

- Amount Salvaged: $250

- Total Claim Amount: $7,750

- The role of 3PLs, brokers or intermediaries

- Many shippers use the services of intermediaries such as brokers or 3PLs (like Logistics Plus) to arrange with carriers for the transportation of their goods. Ordinarily a broker or 3PL does not have any liability for loss or damage since it is not a carrier and does have physical possession or control over the shipments. As a value-added service, Logistics Plus will generally offer to handle the filing and/or collection of claims on behalf of our customers. We also make available the various documents shippers need to file claims. This should not be confused with an assumption of liability, however; and claims must still be filed in your name (not that of Logistics Plus).

If you frequently ship LTL freight or truckload shipments, freight losses and damages are almost inevitable at some point during the process. That’s why it’s important to have an experienced and caring freight management partner on your side. When you work with Logistics Plus, we’ll gladly assist you with the filing or processing of your freight claims, and we’ll go to bat for you with the carriers to best represent your interests. Contact us today to learn more.

As a reminder, the recently approved

As a reminder, the recently approved  For shippers whose LTL shipments were previously rated at class 150 based on density and will now be rated at class 175, this represents about a 15% increase in freight rates. For shippers with an FAK rating of 150, this should not change that rating, but items that were previously in the actual class range may now change. For example, if a shipper has a FAK class 100 rating on items with an actual class of 100-150, and they ship Plastic Articles with a density of 4-6 pcf, this shipment will no longer be subject to the FAK class 100 and will instead move at the actual class of 175.

For shippers whose LTL shipments were previously rated at class 150 based on density and will now be rated at class 175, this represents about a 15% increase in freight rates. For shippers with an FAK rating of 150, this should not change that rating, but items that were previously in the actual class range may now change. For example, if a shipper has a FAK class 100 rating on items with an actual class of 100-150, and they ship Plastic Articles with a density of 4-6 pcf, this shipment will no longer be subject to the FAK class 100 and will instead move at the actual class of 175.

Shipping freight may seem like a very complex process due to the number of options available. It’s important to understand the differences between Full Truckload (FTL) shipping and Less Than Truckload (LTL) shipping because they are two of the most commonly used transportation options within North America. Shippers must consider size, speed, and price when deciding between a FTL versus LTL. Here are the main differences between FTL and LTL shipments to help you decide which shipping method works best for you.

Shipping freight may seem like a very complex process due to the number of options available. It’s important to understand the differences between Full Truckload (FTL) shipping and Less Than Truckload (LTL) shipping because they are two of the most commonly used transportation options within North America. Shippers must consider size, speed, and price when deciding between a FTL versus LTL. Here are the main differences between FTL and LTL shipments to help you decide which shipping method works best for you.