by logisticsplus | Feb 7, 2019 | News

Supply chain visibility is a key element to success for any business. It allows the products, components, and parts of an organization to be tracked and monitored at all times. The overall goal of supply chain visibility is to strengthen the supply chain by using different technology solutions that make data readily available to customers, suppliers, and partners. Here’s why supply chain visibility is so important in today’s world.

Supply chain visibility is a key element to success for any business. It allows the products, components, and parts of an organization to be tracked and monitored at all times. The overall goal of supply chain visibility is to strengthen the supply chain by using different technology solutions that make data readily available to customers, suppliers, and partners. Here’s why supply chain visibility is so important in today’s world.

Better Customer Service

As supply chains expands and becomes more competitive, customers have more options than ever before. With customers now expecting better and faster service, transparency is key. Supply chain visibility allows for a better flow of information and it takes out the middle-man for communicating information back to customers. By having the ability to track every step of the supply chain process with mobile apps and other cloud-based technologies, customers are more involved and can make more informed decisions about their products.

Order Visibility

Every process of the supply chain begins with a purchase order (PO). In a cloud-based collaboration portal (like eWorldPlus and Veracore, both used by Logistics Plus), warehousing and fulfillment teams can view and manage the queue of orders and requests. A portal can provide suppliers the information needed to meet customer demand, adjust production schedules, and view their inventory levels. Not only will customers be satisfied, order visibility will increase the speed and efficiency of fulfillment and distribution centers. When a warehouse is efficient, it allows for orders to be placed and distributed as quickly as the customer needs it, even during peak seasons.

Carrier Visibility

An effective transportation management system (TMS) is another must-have when improving supply chain visibility. A TMS gives you the ability to create bills of lading and schedule shipments, receive competitive quotes from reputable carriers, track LTL and truckload shipments, and view shipment dashboards. Implementing an effective TMS can help you gain more business and keep existing customers happy.

Problem Solving

Improved communications and problem-solving due to supply chain visibility allows you to locate gaps that are present in your current process. Disruptions such as damaged or late shipments are unavoidable. Having real-time visibility into the supply chain metrics and business intelligence allows a companies to make quick decisions regarding schedules and shipping cycles that reduce these disruptions. Supply chain visibility also allows businesses to proactively contact customers regarding potential service disruptions or delays.

As customers continue to expect higher quality service, supply chain visibility is required. It ensures that all customers, suppliers, and partners are knowledgeable about every aspect of business. From purchase order to final delivery, everything in the supply chain process can be monitored and adjusted. If you are looking to gain control of your supply chain and reduce logistics expenses, request a free analysis today. Logistics Plus has proven supply chain experts that will drive savings and increase supply chain visibility. Contact us today.

by logisticsplus | Mar 21, 2018 | News

Watch this short video on the “Top Reasons Why You Need Logistics Plus.” If you’re not into videos, you can also read this similar online post we published a few months back.

Watch this short video on the “Top Reasons Why You Need Logistics Plus.” If you’re not into videos, you can also read this similar online post we published a few months back.

Interesting in learning more?

by Marketing | Feb 13, 2018 | News

When you think of Valentine’s Day, you probably associate it with an abundance of flowers, boxed chocolates, and sappy love letters. Valentine’s Day is a holiday where millions of Americans will spend substantial sums of money on gifts to express their feelings of love, as they do every year. However, many most likely have no appreciation for the vital role that the transportation industry plays in the delivery of this special day.

When you think of Valentine’s Day, you probably associate it with an abundance of flowers, boxed chocolates, and sappy love letters. Valentine’s Day is a holiday where millions of Americans will spend substantial sums of money on gifts to express their feelings of love, as they do every year. However, many most likely have no appreciation for the vital role that the transportation industry plays in the delivery of this special day.

Valentine’s Day is a great testament to how much consumers are willing to spend to show their love. What few people realize is that behind every bouquet of flowers and box of chocolates is an unseen and highly choreographed dance of logistics. This invisible performance can employ numerous modes of transport encompassing airlines, maritime shipping, as well as trucking, and even railroads. The successful execution of this supply chain will ensure that customers receive the gifts they desire, and the providers are rewarded for their efforts.

Achieving and delivering consistent results can be a challenging task for the Valentine’s Day deadline. Many variables enter the equation, including conditions where flowers are grown, as well as the weather on the big day. Also, careful control of temperatures during transport is critical to ensure no degradation of fragile floral cargoes. While other items purchased during Valentine’s Day may not require the demanding conditions as flowers, forecasting supply and demand for these items, like cards and candies, can affect profitability.

Though many do not consider the supply chain to be a vital component of Valentine’s Day, it’s clear how critical shipping is to this fruitful occasion:

- $19.6 billion: An estimate for how much U.S. consumers will spend on Valentine’s Day according to the National Retail Federation

- 36 million: The number of heart-shaped boxes of chocolate sold for Valentine’s Day each year

- 110 million: Approximately how many roses, the majority being red, will be sold and delivered within a three-day period

- $158.71: The average amount of American men spend on Valentine’s Day

- $2.0 billion: The amount people will spend on flowers this Valentine’s Day

- 60%: The percentage of American roses produced in California

We hope you enjoyed these fun Valentine’s Day supply chain facts. Keep Logistics Plus close at heart when considering your transportation needs throughout the year. We LOVE logistics – it’s in our DNA!

by logisticsplus | Jan 11, 2018 | News

There’s a lot going on in the world of logistics right now. At Logistics Plus, we’ve been keeping pace with many of the current transportation and logistics trends, and here are some things to watch in both trucking and global logistics over the next several years.

There’s a lot going on in the world of logistics right now. At Logistics Plus, we’ve been keeping pace with many of the current transportation and logistics trends, and here are some things to watch in both trucking and global logistics over the next several years.

- Automation. Labor shortages and capacity constraints are driving deep investments in technology and automation, such as load matching, robotics, artificial intelligence, machine learning, APIs, and self-driving vehicles. Many 3PLs are dedicating resources to R&D and innovations, and employees are being empowered to quickly anticipate and address customer demands.

- Ecommerce. Global e-commerce logistics costs are expected to have a 17% CAGR through 2020. A CAGR of that multiple hasn’t been seen in the 3PL market for some time. Traditional bricks-and-mortar store-based distribution models are being replaced with less forgiving e-commerce-based fulfillment models that provide less buffer inventory, require faster transit times, and that demand more precise pick-up and delivery times (including same-day deliveries).

- Amazon. The 900-pound gorilla of the freight world continues to build out its own transportation and logistics network, challenging 3PLs to think outside the box. 3PLs must consider how to both compete and partner with Amazon to deliver the e-commerce and omnichannel logistics solutions retailers will require.

- Taxes and Legislation. The U.S. tax bill will be a huge shot in the arm for the economy. This could lead to much-needed pay increases and capital expenditures as transportation companies work to improve their fleets and increase their capacities. Additionally, the passing of proposed infrastructure funding by Congress could address critical deficiencies in the U.S. transportation network.

- Global Growth. Regional growth in China, Mexico, and India will continue to drive a need for effective logistics solutions in those countries. Tightening regulations in China are resulting in some manufacturing and supply chain shifts to other Asian countries. The fast delivery requirements of e-commerce are leading to near-sourcing trends as manufacturers and distributors try to locate inventory closer to consumers.

- Freight Forwarding. The international freight forwarding industry is riding tailwinds into 2018. Faster speed expectations are driving shifts from ocean to air shipments. Meanwhile, ocean carriers are adding newer and larger ships which could result in excess ocean capacity and lower rates.

- Consolidation. M&A activity within the logistics industry will continue in this seller-friendly market as 3PLs look for both growth and technology opportunities. Larger mergers are expected in the high-velocity fulfillment e-commerce area, while strategic partnerships – particularly outside the U.S.—are being created to address niche markets within core verticals and concentrated geographies.

What trends will you be watching in 2018 and beyond? What’s your most pressing logistics or supply chain challenges for the coming year? Some informational links are provided below if you are interested in further reading on trends within the transportation and logistics industry.

Key Takeaways from the 3PL Value Creation Chicago Summit 2017 (Armstrong & Associates)

Ten Trends Trucking Should Watch in 2018 (Fleet Owner)

3 Tech Trends Shaping the Future of Global Logistics (Supply Chain 247)

2018 Third-Party Logistics Study – Key Takeaways (3PL Study)

by logisticsplus | Nov 15, 2017 | News

In case you haven’t had a chance to read the 2018 Third-Party Logistics Study, here are some key takeaways from the results and findings of the 22nd annual report by Dr. C. John Langley and Infosys:

- Global Results Have Been Mixed. Overall 3PL revenues, estimated at $802B in 2016, have declined slightly over the past several years despite increases in the Asia-Pacific and North America.

- Logistics Costs Are Increasing. Logistics expenditures as a percentage of sales revenues increased to 11% in the current year, up from 10% the previous year, as a higher percentage of shippers’ transportation spend is being outsourced with 3PLs (reportedly 55% in most current year).

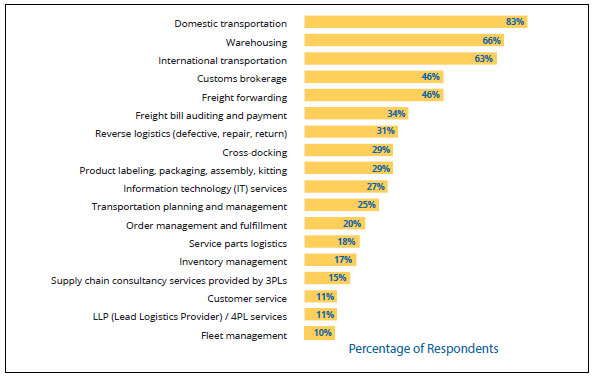

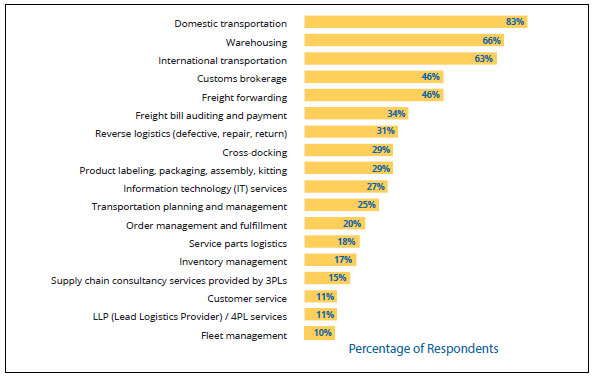

Shippers Are Outsourcing More. 61% of shippers in the study noted that they intend to increase their usage of outsourced logistics services. Domestic transportation and warehousing remain the two most outsourced logistics services; however, outsourcing of information technology (IT) services had the greatest year-over-year increase for the second consecutive year (see graph).

Shippers Are Outsourcing More. 61% of shippers in the study noted that they intend to increase their usage of outsourced logistics services. Domestic transportation and warehousing remain the two most outsourced logistics services; however, outsourcing of information technology (IT) services had the greatest year-over-year increase for the second consecutive year (see graph).- The IT Satisfaction Gap Is Widening. Despite more outsourcing of IT activities, fewer shippers are satisfied with these services; an indication that, perhaps, shippers’ expectations have increased as technology has improved or because shippers are seeking enhanced analytical capabilities to help drive more effective supply chain decisions.

- 3PL Capabilities Are Expanding. As more conversations around supply chain efficiency have entered the board room, 3PL providers are refining and expanding their core competencies, which in turn is allowing shippers to focus more on their core competencies.

If you haven’t already, you should download and read the entire 2018 Third-Party Logistics Study. The authors also share some perspectives on the impact blockchains could have on logistics; automation and digitization in the supply chain; and the logistics talent revolution.

If you’re a shipper looking to outsource some or all of your transportation, logistics, or supply chain activities, let us know. We stand ready to help businesses address their most critical logistics challenges.

Supply chain visibility is a key element to success for any business. It allows the products, components, and parts of an organization to be tracked and monitored at all times. The overall goal of supply chain visibility is to strengthen the supply chain by using different technology solutions that make data readily available to customers, suppliers, and partners. Here’s why supply chain visibility is so important in today’s world.

Supply chain visibility is a key element to success for any business. It allows the products, components, and parts of an organization to be tracked and monitored at all times. The overall goal of supply chain visibility is to strengthen the supply chain by using different technology solutions that make data readily available to customers, suppliers, and partners. Here’s why supply chain visibility is so important in today’s world.

Watch this short video on the “Top Reasons Why You Need Logistics Plus.” If you’re not into videos, you can also

Watch this short video on the “Top Reasons Why You Need Logistics Plus.” If you’re not into videos, you can also

When you think of

When you think of

There’s a lot going on in the world of logistics right now. At Logistics Plus, we’ve been keeping pace with many of the current transportation and logistics trends, and here are some things to watch in both trucking and global logistics over the next several years.

There’s a lot going on in the world of logistics right now. At Logistics Plus, we’ve been keeping pace with many of the current transportation and logistics trends, and here are some things to watch in both trucking and global logistics over the next several years.