by logisticsplus | Feb 17, 2022 | News

The Commodity Classifications Standards Board (CCSB) has published a new supplement to the National Motor Freight Classification (NMFC®). These NMFC changes are effective 04/09/2022. Some notable changes are listed below.

The Commodity Classifications Standards Board (CCSB) has published a new supplement to the National Motor Freight Classification (NMFC®). These NMFC changes are effective 04/09/2022. Some notable changes are listed below.

Subject 1 – Cookware, Items for cookware made of different metals and alloys were all combined into one item (52880) with a full density class grouping. 52890, 52895, 52896, and 52900 all were canceled.

Subject 3 – Detectors, Fire, Previous Items (61552 and 61555) established class based upon actual value. These items were canceled and replaced by 61550 which establishes a single class of 110.

Subject 4 – Ink, Dry Ink or Toner, Item 101740 was changed from a single class 70 to three density-based classes. Dry Ink Cartridges were removed from 116030 and added to 101740.

Subject 5 – Cables, mechanical control # 39510, Class changed from a straight 70 to a full density item.

Subject 6 – Fruits, Meats, Vegetables, and Dairy Products #76850. Density breaks and classes changed. See Revised Item.

Subject 7 – Cough Drops or Throat Lozenges, #58730, Class changed from 65 to 100

Subject 9 – Tape Friction or Insulating including electrical tape, Items 49450 and 49680 canceled and replaced with 49680 which is a full density scale.

Subject 10 – Oils, Cooking Oils and vegetable Shortening, Item 73238 revised to include Cooking Sprays. Still class 65.

Subject 13 – Door Lites, Sidelites, or transom Lites, Old item 34943 is canceled and replaced with 34250 which has 8 subs based on Dimensions and density.

Subject 14 – Bags, apparel, bedding, clothing, or garment storage, Item 20510 is canceled and replaced by 20580 which is a full-scale density item.

Subject 15 – Foodstuffs: Kernels or Seeds (pumpkin or sunflower), Kernels, and Seeds removed from Item 73238 and moved to new Item 73705 which has three classes based on density.

Subject 16 – Combs, Brushes, Crimpers, Fluters, Straighteners or Wavers; Irons or Wands, Item 61370 is canceled and rolled into Item 62290. Class on 62290 changed from 85 to 125.

Subject 17 – Bins or Shelving, Item 82360 – Bins or shelving is canceled and added to item 82270 – Metallic or Wooden Furniture, which is a full density item. Previously is it was either 150 or 70 depending upon SU or KD.

Subject 18 – Binoculars, Binoculars, Field glasses, opera glasses, etc…now a straight class 150. Class used to be dependent upon actual value.

Subject 21 – Egg Beaters, Item 100520 which was class 85 now canceled, and now egg beaters are part of Tools, hand, kitchen, NOI, a full density item.

Subject 22 – Bayonets, Swords, scabbards, Class changed from 100 to a three-class scale based upon density.

Subject 24 – Definition or Specifications for Crates

Subject 25 – Filters, cigarette, Item 69083, Class changed from 100 to 200.

Subject 26 – Explosives, Item 64300, Item amended to clarify that explosives moving under its provisions ‘must’ be transported in DOT authorized packaging.

Subject 27 – Hazardous materials, ORM-D removed since Shippers are no longer authorized to use these markings.

Subject 36 – Petroleum Xylidine, Item 155460, Item canceled. See Item 45615 – Poisonous or Toxic Materials.

by logisticsplus | Nov 16, 2021 | News

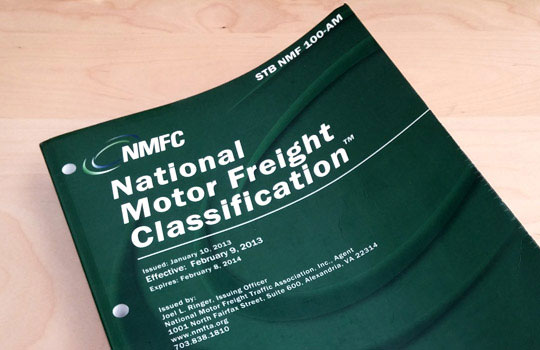

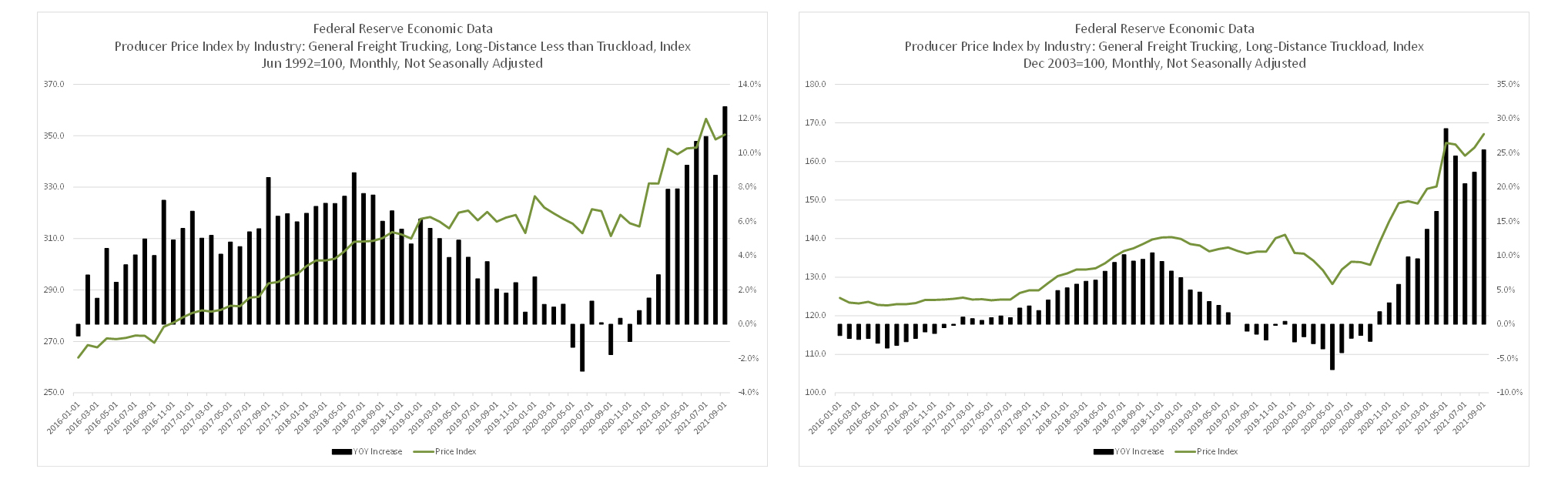

Anyone involved in domestic transportation now knows all too well that freight rates have been skyrocketing to historic levels. According to Transportation and Warehousing produce price indices tracked by the U.S. Federal Reserve, year-over-year industry-wide less-than-truckload prices have risen between 8-14% in recent months, and full truckload prices have risen between 20-30% (and diesel fuel prices are up 27% on top of that).

Anyone involved in domestic transportation now knows all too well that freight rates have been skyrocketing to historic levels. According to Transportation and Warehousing produce price indices tracked by the U.S. Federal Reserve, year-over-year industry-wide less-than-truckload prices have risen between 8-14% in recent months, and full truckload prices have risen between 20-30% (and diesel fuel prices are up 27% on top of that).

The message is clear, reducing overall supply chain costs right now will be a significant challenge. In fact, in the 30th Annual Study of Logistics and Transportation Trends published in the September 2021 issue of Logistics Management, only 8.2% of shippers surveyed feel that reducing costs is a primary objective right now. That compares with 21.8% in 2020 and 29.8% in 2019. What are the new primary objectives? 20.5% say maximizing asset utilization, 35.6% say increasing customer satisfaction, and 35.6% say maximizing profitability are all now higher primary objectives.

(Click to Enlarge)

So how can shippers try to offset these rate increases as they look to maximize profitability over the coming months and year? Here are some tips from your friends at Logistics Plus:

- Ship larger shipments less often. Even with truckload rates at all-time highs, a larger load of the product will generally ship more cost-effectively than multiple smaller loads.

- Minimize the cubic footprint of shipments (i.e., smaller, denser) to avoid overlength, minimum cubic capacity, and capacity load charges assessed by some carriers.

- Consolidate orders where possible to reduce unnecessary freight charges (the Logistics Plus Business Intelligence department can review your historical data to see about potential recommendations).

- Utilize the Logistics Plus North American Division (NAD) to help spot quote some of your larger shipments. Sometimes shipments over five pallets or 5,000 pounds (as a guideline) can be spot quoted for less money if it moves in a desirable backhaul lane for a carrier.

- Utilize regional warehousing to optimize/balance inventory to be as close to final customers as possible (Logistics Plus has multiple warehouses located across the United States).

- Improve BOL accuracy to minimize re-weigh, re-class, and inspection fees (carriers are getting punitive on inaccurate bills of lading).

- Improve order accuracy to minimize re-consignments and re-deliveries (don’t ship a shipment any more than you have to).

- Consider implementing a “prepaid and add” program (if you haven’t already) to mark up your freight costs by X% and pass that on to your customers/vendors to help offset your freight costs.

- Implement a freight invoice consolidation, auditing, and payment program to gain further visibility and insights into your freight spend and maximize recovery of refundable monies (e.g., guaranteed failures, orders paid but not tendered, address corrections, etc.).

Want to explore these and other ideas? Contact Logistics Plus, and let’s talk.

by logisticsplus | Oct 14, 2021 | News

The Commodity Classifications Standards Board (CCSB) has published a new supplement to the National Motor Freight Classification (NMFC®). These NMFC changes are effective 12/04/2021. Some notable changes are listed below.

The Commodity Classifications Standards Board (CCSB) has published a new supplement to the National Motor Freight Classification (NMFC®). These NMFC changes are effective 12/04/2021. Some notable changes are listed below.

Subject 1 – Foodstuffs, Item 73227 canceled and replaced by 72310, 73260, and 73365.

Subject 2 – Dehydrated Cheese New Item 55450, revised Item 55470 – Cheese food, and Item 73260 – Snack Foods

Subject 3 – Box Group. Items 29080 and 29110, 29140 and 29780, 29800, 29805, 29810, 112360 and Canceled and replaced with Item 29785 or 112870 ( 29785 – Boxes or Cartons, fiberboard or paperboard, NOI., 112870 – Lumber NOI, or Wood, built-up or combined, or Plywood, NOI)

Subject 4 – Item 101720 Ink and related materials

Subject 5 – Faucets

Subject 6 – Toilet or Bidet Seats

Subject 7 – Boxes, Chests or Cabinets, Tool, Ammunition or Fishing Tackle

Subject 8 – Mixing Machines (Asphalt, cement, concrete or mortar)

Subject 9 – Item 59380 – Solutions or Sterile Water, intravenous

Subject 10 – Item 680 – Packing or Packaging – General

Subject 11 – Item 682 – Pictorial Precautionary Markings

Subject 12 – Item 689 – requirements and Conditions for Test Shipments, CANCELED, obsolete

Subject 13 – Withdrawn to continue research (Item 39510 – Cables)

Subject 14 – Charcoal, Charcoal Briquettes or Charcoal Pellets

Subject – 15 – Broilers, Grills, Roasters or Stoves, cooking, outdoor type, electric

Subject 16 – Manifolds, gas, furnace, stove, or heater

Subject 17 – Kits, pregnancy test – New Item 56975 replaces 59793

Subject 18 – Cord, Cordage, Rope, other than wire rope, String or Twine, NOI,

Subject 19 – Washers; Gaskets; or Packing Devices, Forms or Shapes

Subject 20 – Withdrawn to Continue Research – Cookware, cast iron, NOI

Subject 21 – Wood Chips or Wood Chunks,

Subject 22 – 186080 Sod Cutters, etc – Canceled and replaced by Items 130207 and 186620

Subject 23 – ITEM 292 – SPECIFICATIONS FOR FIBER PAILS

Subject 24 – 100800 Dispensers, tea or ground coffee, household – Canceled

Subject 25 – 122000 Grading or Road Making Attachments or Implements, or Parts thereof

Subject 26 – 10920 Fenders, 21470 Baptistries, 164390 Racks and Related Articles – Packaging exceptions changed

Subject 27 – Various items – Reference to Package 2039 would be removed from item 24080, as it would not provide sufficient protection in today’s less-thantruckload environment. Concurrently, other changes are proposed for clarification and Simplification.

Subject 28 – Various Items – Simplifies the minimum packaging requirements in the involved items to require “in bags” in lieu of the specific types currently named. Other changes to the minimum packaging requirements are proposed for clarification and simplification.

Subject 29 – Various Items – simplify the minimum packaging requirements in the involved items to require “in bags” in lieu of the specific types currently named. Other changes to the minimum packaging requirements are proposed for clarification and simplification.

Subject 30 – Various Items – Cancels items 46170, 46180, 46190, 46570, 46670 and 46700 with reference to item 44155, items 46540 and 46640 with reference to item 44515, items 46160 and 46460 with reference to item 45467, and item 46300 with reference to item 45615. These changes are proposed to provide classes reflective of the respective hazards of, and regulations applicable to, the involved materials. The changes are also in the interest of clarification, simplification and uniformity. Since item 46170 is the only item that authorizes Package 355, the package would be concurrently canceled as having no further application. This proposal would also add the term “Baking Soda” to the listing in item 46220 for Sodium Bicarbonate in the interest of clarification.

Subject 31 – Cancels items 42870, 42920, 43180 and 43230 with reference to item 44155, items 43170 and 45460 with reference to item 44500, and items 43080, 43260 and 43290 with reference to item 45615. These changes are proposed to provide classes reflective of the respective hazards of, and regulations applicable to, the involved materials. The changes are also in the interest of clarification, simplification and uniformity. Note, item 45462 would be canceled as having no further application.

Subject 32 – Cancel item 91220 with reference to items 44500, 44515 and 64300, as applicable. In addition to providing clarification, simplification and uniformity, this change would assign classes reflective of the respective hazards of and regulations applicable to box toe gum.

Subject 33 – Amends the provisions of item 42652 to remove the “bomb burst” symbol (), add language further restricting the item’s application to materials not required by the DOT to bear a Hazard Class or Hazard Division label or placard, and refer to a new attendant Note clarifying that item 42652 does not apply on materials regulated by the DOT as hazardous and required to bear a Hazard Class or Hazard Division label or placard. The proposed new Note would direct the Classification user to other items for classes applicable to such hazardous materials.

Subject 34 – Amend the provisions of item 171410 to remove the “bomb burst” symbol (), add language further restricting the item’s application to materials not required by the DOT to bear a Hazard Class or Hazard Division label or placard, and maintain class 70, per the present sub 2 provisions of the item. A new attendant Note would be established to clarify the item’s intent and would direct the Classification user to other items for classes applicable to such hazardous materials.

Subject 35 – The following numbered packages are canceled and reference(s) to them in individual item descriptions are removed:

- 759

- 762

- 773

- 776

- 788

- 789

- 794

- 795

- 801

- 802

- 814

- 818

- 934

- 1306

- 2332

- 2387

Subject 36 – The following numbered packages are canceled and reference(s) to them in individual item descriptions are removed:

- 825

- 826

- 827

- 834

- 838

- 841

- 846

- 868

- 870

- 881

- 886

- 911

- 919

- 932

- 978

- 1029

- 2304

- 2305

- 2413

- 2529

Subject 37 – The following items are canceled as obsolete:

- 81370

- 83740

- 87590

- 87630

- 88540

- 89710

- 89990

- 90970

- 91120

- 91140

- 91200

- 91280

- 91400

- 91440

Subject 38 – The following items are canceled as obsolete:

110120

- 110160

- 110270

- 110290

- 110497

- 112980

- 115720

- 115880

- 116400

- 116670

- 116730

- 131310

- 131620

- 134100

- 134220

- 134280

- 134300

- 134570

- 135620

- 135660

Subject 39 – The following items are canceled as obsolete:

- 117200

- 117240

- 117360

- 118220

- 119060

- 125540

- 125600

- 125640

- 125660

- 126040

- 126120

- 127760

Subject 40 – The following items are canceled as obsolete:

- 98870

- 99190

- 99200

- 99210

- 99230

- 99250

- 99320

by logisticsplus | Sep 9, 2021 | News

Understanding how freight pricing varies by transportation mode can help determine the most cost-effective solution for your business. By learning the ins and outs of pricing variables, you can find ways to cut costs, increase efficiency, and avoid overpaying for services you don’t need. Quite frankly, determining the mode of transport is one of the most critical business decisions you can make.

Understanding how freight pricing varies by transportation mode can help determine the most cost-effective solution for your business. By learning the ins and outs of pricing variables, you can find ways to cut costs, increase efficiency, and avoid overpaying for services you don’t need. Quite frankly, determining the mode of transport is one of the most critical business decisions you can make.

Less-than-truckload (LTL)

LTL shipping refers to freight deliveries that are too large to ship via parcel but too small to fill an entire truck. LTL carriers sell multiple shippers space on the same truck and LTL shipments are often more complex to price than other modes of transportation. Pricing is calculated using several factors, including total weight, density, freight classification, distance, and accessorials.

Full Truckload (FTL)

Full truckload is used when a single shipper has enough freight to fill up an entire truck. Truckload rates tend to be the most simple to determine since they are based on a per-mile or flat door-to-door rate. Not surprisingly, capacity also has a major impact on full truckload prices.

Parcel

Standard parcel shipping has become one of the highest-profile sectors within the shipping industry due to the rise of e-commerce. Parcel is similar to LTL freight pricing. Cargo is priced by the pound, dimensions, and transit times. There are additional charges for packages that fall outside of certain dimensions or weight thresholds. Standard, first-class, and overnight options are usually offered for parcels which play a part in determining the price.

Airfreight

Airfreight is an often-used mode of transportation for time-critical shipments. Air carriers will charge by either volumetric weight (also known as dimensional weight) or actual weight, depending on which is more expensive. If the volumetric weight exceeds the actual weight of the product, the volumetric weight becomes the chargeable weight.

Ocean Freight

In comparison to air freight, ocean freight tends to be less expensive. Charges are based on the nature of goods being transported, the weight or volume, distance to the destination port, and the rates set by the shipping carrier. Ocean freight prices also depend on the shipper’s decision to go with an FCL or LCL shipment. Full Container Loads (FCL) are best suited for large shipments, while Less than Container Loads (LCL) are more suitable for smaller shipments.

Rail/Intermodal

Rail and intermodal options tend to be the most cost-effective way to transport cargo. Rail containers are booked on a per-mile basis, similar to truckload shipping. Intermodal providers have agreements in place with railroads to transport cargo across the various rail networks.

Contact us to get started if you’d like to request a free quote on your next ground, air, ocean, or rail shipment. With over 25 years of experience, our team of experts is ready to assist you with your transportation needs.

by logisticsplus | Apr 6, 2021 | News

FOR IMMEDIATE RELEASE

Logistics Plus Ranks Among America’s Top 3PLs According to Multiple Transport Topics 2021 Lists

Logistics Plus ranks as a top freight brokerage firm and a top dry storage warehousing firm

in the $231 billion U.S. third-party logistics industry.

ERIE, PA (April 6, 2021) – Logistics Plus Inc., a leading worldwide provider of transportation, logistics, and supply chain solutions, has again been named to two top third-party logistics provider lists in the April 5, 2021 issue of Transport Topics magazine. Logistics Plus ranks number 61 on the Transport Topics Top Freight Brokerage Firms list and number 62 on the Transport Topics Top Dry Storage Warehousing Firms list.

ERIE, PA (April 6, 2021) – Logistics Plus Inc., a leading worldwide provider of transportation, logistics, and supply chain solutions, has again been named to two top third-party logistics provider lists in the April 5, 2021 issue of Transport Topics magazine. Logistics Plus ranks number 61 on the Transport Topics Top Freight Brokerage Firms list and number 62 on the Transport Topics Top Dry Storage Warehousing Firms list.

Industry research firm Armstrong & Associates estimates the U.S. third-party logistics (3PL) market grew 8.8% in 2020, bringing the total market to $231.5 billion. Domestic transportation management represents the largest segment of the U.S. 3PL market, followed by international transportation management, value-added warehousing and distribution, dedicated contract logistics, and logistics software.

Transport Topics publishes an annual list of the top 50 logistics companies along with its sector lists for freight brokerage, dry storage warehousing, refrigerated warehousing, dedicated, ocean freight, and air freight services. To read more about the largest logistics companies in America, visit Transport Topics at https://www.ttnews.com/top50/logistics/2021.

About Transport Topics

Transport Topics is the news leader in freight transportation and has been for the last 80 years. When it comes to major issues, industry events, and new developments, Transport Topics journalists are there first and most often. Our hallmark coverage of the regulatory environment and the business and technology landscapes makes TT unique — a major multimedia channel, personalized for transportation. Read us daily at www.ttnews.com.

About Logistics Plus Inc.

Logistics Plus Inc. is a 21st-century logistics company that provides freight transportation, Warehousing, fulfillment, global logistics, business intelligence, and supply chain management solutions through a worldwide network of talented and caring professionals. The company was founded 25 years ago in Erie, PA, by local entrepreneur Jim Berlin. Today, Logistics Plus is a highly regarded, fast-growing, and award-winning transportation and logistics company. With a Passion For Excellence™, its employees put the “plus” in logistics by doing the big things properly, plus the countless little things, that together ensure complete customer satisfaction and success.

Logistics Plus Inc. is a 21st-century logistics company that provides freight transportation, Warehousing, fulfillment, global logistics, business intelligence, and supply chain management solutions through a worldwide network of talented and caring professionals. The company was founded 25 years ago in Erie, PA, by local entrepreneur Jim Berlin. Today, Logistics Plus is a highly regarded, fast-growing, and award-winning transportation and logistics company. With a Passion For Excellence™, its employees put the “plus” in logistics by doing the big things properly, plus the countless little things, that together ensure complete customer satisfaction and success.

The Logistics Plus® network includes offices, warehouses, and agents located in Erie, PA; Akron, OH; Buffalo, NY; Chicago, IL; Chino, CA; Cleveland, OH; Dallas, TX; Des Moines, IA; Detroit, MI; Fort Worth, TX; Haslet TX; Houston, TX; Laredo, TX; Lexington, NC; Los Angeles, CA; Melbourne, FL; Nashville, TN; New York, NY; Olean, NY; San Francisco, CA; Australia; Bahrain; Belgium; Canada; China; Colombia; Czech Republic; Egypt; France; Germany; India; Indonesia; Japan; Kazakhstan; Kenya; Libya; Mexico; Netherlands; Poland; Saudi Arabia; Taiwan; Turkey; UAE; Ukraine; Uganda; and United Kingdom; with additional agents around the world. For more information, visit www.logisticsplus.com or follow @LogisticsPlus on Twitter.

Media Contact:

Scott G. Frederick

Vice President, Marketing

Logistics Plus Inc.

(814) 240-6881

scott.frederick@logisticsplus.com

Click the image below to download the Logistics Plus logo:

Page 3 of 12«12345...10...»Last »

The Commodity Classifications Standards Board (CCSB) has published a new supplement to the National Motor Freight Classification (NMFC®). These NMFC changes are effective 04/09/2022. Some notable changes are listed below.

The Commodity Classifications Standards Board (CCSB) has published a new supplement to the National Motor Freight Classification (NMFC®). These NMFC changes are effective 04/09/2022. Some notable changes are listed below.

Understanding how freight pricing varies by transportation mode can help determine the most cost-effective solution for your business. By learning the ins and outs of pricing variables, you can find ways to cut costs, increase efficiency, and avoid overpaying for services you don’t need. Quite frankly, determining the mode of transport is one of the most critical business decisions you can make.

Understanding how freight pricing varies by transportation mode can help determine the most cost-effective solution for your business. By learning the ins and outs of pricing variables, you can find ways to cut costs, increase efficiency, and avoid overpaying for services you don’t need. Quite frankly, determining the mode of transport is one of the most critical business decisions you can make.

Logistics Plus Inc. is

Logistics Plus Inc. is